EASTHAM — The draft warrant for town meeting on May 5 is nearly 50 pages long and includes a new zoning code for the North Eastham business district, an eminent domain purchase of two duplex units, and a request to the state for a real estate transfer fee on the portion of home sales over $1 million.

Despite all that, the most contentious topic, and the one that dominated the select board’s discussion of the warrant on March 24, is one that isn’t directly up for a vote: the select board’s decision in January to adopt a residential tax exemption (RTE) starting in fiscal 2026, which begins in July.

After several years of voting against an RTE, select board chair Aimee Eckman changed her mind in January and joined board members Jamie Demetri and Suzanne Bryan in voting to implement an exemption later this year. Since then, dozens of critics — many from the Eastham Part-Time Resident Taxpayers Association (EPRTA) — have spoken at select board meetings asking Eckman and her board to reconsider.

Article 9A, which is this year’s only citizens petition on the warrant, asks the select board to “hire a qualified, independent entity to audit and develop a comprehensive tax strategy for the town’s infrastructure and community-based needs before moving forward with any changes to the FY2026 tax structure.” It is nonbinding.

“The Select Board’s tax and spend strategy fails to meet the standard of thoughtful and targeted assistance for its citizens,” the article says in its “Discussion” section. The select board “did not present any rationale based on facts and data why further tax breaks for local special interest groups are justified,” the petition says.

The RTE is a policy created by state law that allows towns to set a certain percentage of the average home price in town — in Provincetown and Truro it is 35 percent, while in Wellfleet it is 32.5 percent — as the fixed amount that resident homeowners may deduct from the assessed value of their homes when calculating property taxes.

Because the policy is revenue-neutral, towns tally all the exemptions and then set a new, slightly higher residential tax rate on the remaining assessed value of residences in town, which decreases the value of the exemption on large properties owned by residents and raises taxes on properties owned by nonresidents.

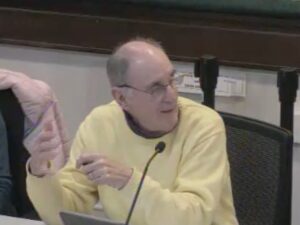

“I think this is a stall tactic against the RTE,” said select board member Robert Bruns at the March 24 meeting. “And while I’m very against the RTE from an ethics perspective, this is not the way to go against it.”

Article 9A was sponsored by Wendy Gamba, a part-time Eastham resident who is registered to vote in New Haven, Conn.; she serves as treasurer for the EPRTA. She told the Independent in an email that the petition was a “collectively written document with the inputs of many concerned taxpayers.”

The petitioned article “is not about the RTE,” Gamba wrote. “It is about the broader issues that are at play in our community related to taxes.”

Taxes in Eastham have increased rapidly, she wrote, and Proposition 2½ overrides “make it very difficult for households to plan and budget,” which she described as a concern for resident and nonresident taxpayers alike.

Bruns said that Finance Director Rich Bienvenue’s “preparation and knowledge is far superior to our surrounding towns.” Bruns abstained on the select board’s vote on whether to endorse Article 9A, while the other four board members voted against it.

Everything else on the warrant received a unanimous recommendation, including Article 4A, which would add $200,000 to the town’s “overlay reserve” account to help smooth the implementation of the RTE, and Article 5A, which would accept the state’s “seasonal community” designation for Eastham.

That designation, which was created by last year’s Affordable Homes Act, gives “seasonal communities” access to a basket of policies to help them address their housing crises, including the right to develop housing specifically for town employees, the right to create year-round market-rate rental housing trusts, as Provincetown and Truro have done, and the right to raise their RTEs from the statewide maximum of 35 percent of the value of the average home in town to a new maximum of 50 percent.

The designation does not yet come with direct state funding, although that remains a possibility in future years, according to state Sen. Julian Cyr, who authored the provision.

“Anything that gives us the option to get more state funding, especially in the area of housing, is something we should be jumping on,” said select board member Jerry Cerasale.

Cerasale has voted against adopting an RTE in Eastham, but he was enthusiastic about the other options provided by the seasonal community designation and noted that the town “isn’t forced to use them.”

Duplexes and Transfer Fees

Article 4D on the warrant would authorize the town to take by eminent domain two duplex units owned by the family of David Delgizzi, a Weston resident who owes back property taxes on rental properties throughout the Outer and Lower Cape.

Eastham took possession of 2815 and 2835 Route 6 in 2020 after the owners fell far behind on their taxes, but because they are duplex units connected to properties the Delgizzis still own, it has been difficult for the town to maintain them properly. Article 4D would allow the town to borrow against its short-term rental tax revenue to take the other two units — 2825 and 2845 Route 6 — and pay the Delgizzis $850,000 for them.

The properties are “an ideal location” for a new wastewater pump station, Bienvenue said on March 24, and would also help the town divert runoff from Route 6 away from Salt Pond, which has frequently suffered from toxic algae blooms after storms. The duplex units would be repaired and rented in the short term and could be redeveloped into additional units in the long term, according to the warrant language.

Article 6A is a “home rule petition” that allows the select board to ask the legislature for permission to adopt a 3-percent real estate transfer fee on the portion of real estate sales over $1 million — a request that 19 other towns have also made.

Bienvenue said he was skeptical that the state would approve the petition, “but it might influence legislators to create a statewide option” for a transfer fee that towns around the state could adopt.

According to Article 6A, the exemption amount could be amended by a two-thirds vote at a future town meeting.

Finally, the longest article on the warrant is 7A, a new zoning code that aims to create a walkable mixed-use commercial and residential area in the town’s North Eastham Corridor Special District. The town has had many public meetings on the new code, and the planning board has some amendments to offer on town meeting floor that aim to preserve industrial uses around Holmes Road.

The select board signaled that it expects to be in agreement with the planning board on those amendments and the underlying article, members said on March 24.

Editor’s note: An earlier version of this article, published in print on March 27, identified Wendy Gamba as an Eastham resident. She has a home in Eastham but is registered to vote in New Haven, Conn. Also, because of an editing error, the amount of the proposed real estate transfer fee in Article 6A was reported as one percent rather than 3 percent.