EASTHAM — Barbara Niggel, the owner of Willy’s World Wellness and Conference Center, has filed for Chapter 11 bankruptcy, unable to pay off a $6.87-million short-term commercial loan on her property that came due in a balloon payment last September.

The bankruptcy filing, initially made in mid-February by Niggel, put a hold on the fast-mounting interest and default payments due on the loan. The action also put a hold on the lender’s right to foreclose and sell Niggel’s property, something the lender has asked the bankruptcy court to overturn.

The 9.4-acre property at 4730 Route 6 in Eastham, which was used to secure the one-year loan, is owned by Niggel’s limited liability company called Goeroe’s Goldens. Three businesses operate there: Willy’s Gym, in which Niggel is the majority shareholder at 91 percent; Stow Away Storage, which is solely owned by Niggel; and a seasonal business called Paddle Cape Cod, which is owned by Niggel’s son, Benten.

The property is strategically located in the heart of the planned North Eastham village center between the 10.9-acre former T-Time driving range to the north and the 3.5-acre Town Center Plaza to the south. Both of those parcels have been purchased by the town.

A 10.99% Interest Rate

Niggel borrowed $6.87 million from Capital Funding Financial in August 2022. The Florida-based company immediately assigned the loan to NuBridge Commercial Lending of California, which continues to hold the promissory note.

The interest rate during the loan’s one-year term was 10.99 percent, with the borrower required to make monthly interest-only payments of $62,917. The entire debt was due to be paid off in a balloon payment at the end of the loan’s one-year term, in September 2023.

Niggel stopped making payments on the loan in May 2023, putting the mortgage in default as of June 1, 2023. At the time of the bankruptcy filing in mid-February, NuBridge calculated the total principal and interest at more than $7,750,928.

Under the terms of the loan, the lender has no obligation to offer refinancing, leaving Niggel with the options of trying to quickly refinance the property with another lender to pay off NuBridge, selling the property, or declaring bankruptcy.

A recent appraisal put the value of the Willy’s property at $12.1 million. The town has assessed the land and buildings at $4.26 million.

A Proposed Reorganization

Niggel’s proposed plan for reorganization under Chapter 11 bankruptcy, based on the latest amended version filed in mid-June, lays out how she will pay back NuBridge and her other creditors during the two years following the date the plan goes into effect.

According to the court documents, the payment plan would be funded primarily from either a refinancing or the sale of the property, with interim payments made with revenue from Niggel’s commercial operations. According to the court filing, Willy’s and the debtor (which are Niggel in both cases, as she is both the major shareholder in Willy’s and the sole principal of Goeroe’s Goldens) have renegotiated the monthly rent, lowering it to $47,500 for the rest of the current year. The rent would then increase to $50,000 per month.

Stow Away, again with Niggel as both landlord and tenant, pays rent of $5,000 per month. Paddle Cape Cod, owned by Niggel’s son, pays $20,000 per season.

Under the reorganization plan, Niggel would pay NuBridge only the monthly interest on the original amount of the loan, $6.87 million. The interest rate would be 7.5 percent rather than the original rate of 10.99 percent. The plan needs the court’s approval.

NuBridge filed a motion in June opposing Niggel’s plan. On Aug. 7, NuBridge’s attorney filed a second motion asking the court to remove the hold on the loan repayment that has been in effect since February. At the loan’s agreed-upon interest rate of 10.99 percent, the interest owed for the six months since the bankruptcy filing totals $377,506. NuBridge has also asked the court for authorization to foreclose on the mortgage. A hearing on that request is set for Sept. 10 in the federal bankruptcy court in Boston.

Niggel did not respond to a request for comment before this week’s deadline.

The short-term loan is not the only outstanding debt on the Willy’s property, according to the bankruptcy filing. Niggel owes Eastham about $24,000 for past due water and sewer charges. She also has $275,000 in unsecured claims, comprising $180,000 in private loans obtained from people Niggel has a relationship with, about $28,000 in utility charges, $65,000 in legal fees to the Ascendant Law Group of Andover, and a $1,700 debt to a supplier. The list of people who gave Niggel private loans includes Jennifer Jordan, a Charlestown resident who loaned Niggel $120,000. Niggel owes $35,000 to Deborah Mangelus, an Eastham psychic and spiritual consultant, and $25,000 to Paige Coker Heiman. Mangelus lives in a house in Eastham owned by Niggel, according to the town assessor’s records.

The proposed reorganization calls for paying those unsecured claims from the proceeds of a refinance or sale of the property no later than two years from the plan’s effective date.

The Road to Bankruptcy

In her filing, Niggel cast blame on the town for delaying an expansion of storage units on the Stow Away site in 2018. After obtaining a $4.6-million refinancing to fund the expansion, she said, the town changed zoning restrictions and put a moratorium on new construction while she was in the middle of permitting. She was required to apply for a special permit, she argued.

“After countless hearings, excessive cost, and two and a half years, the special permit to complete the storage build out was granted,” said Niggel in her court filing.

During the delay in permitting the new storage units, a November 2019 fire severely damaged the property, said Niggel, and Willy’s had to cease operations. The repairs took several months, she said, and she was required to install a new sprinkler system “and generally bring the facility to 2020 standards.” The cost of the repairs and upgrades topped $1.2 million, she said.

With the agreement of the lender, Niggel used a portion of the funds she had borrowed to expand the storage units.

The property was ready to open in March 2020, but the pandemic kept Willy’s closed for the next several months. In July 2020, she was allowed to open at 25-percent capacity, following Covid restrictions. Willy’s was not able to fully reopen until 2022.

Niggel took out the one-year commercial loan in August 2022 to stabilize her business, she said. An ice storm on Christmas Day 2022 caused massive damage resulting from frozen and burst pipes at Willy’s. The gym’s cardio, strength, and fitness facilities were closed until the end of April 2023.

But reports in the Independent have told a different story from the one Niggel gave in her court filings.

In November 2019, the Eastham Fire Dept., responding to a report of smoke in the locker room, checked the whole building and found an improperly vented gas heater in the sauna area and several electric space heaters throughout the facility, which fire officials ordered removed. The fire alarm and sprinkler systems had also stopped working, according to the Independent’s account. The fire chief allowed Willy’s to stay open under a fire watch that required staff members to check the entire building daily for any signs of danger.

On Dec. 7, 2019, Niggel held an after-hours party at the gym despite the lack of a fire suppression system. Videos of the party, which came to the attention of town officials, showed the exit door was blocked by equipment that had been pushed against the walls. That gathering also violated Niggel’s liquor license.

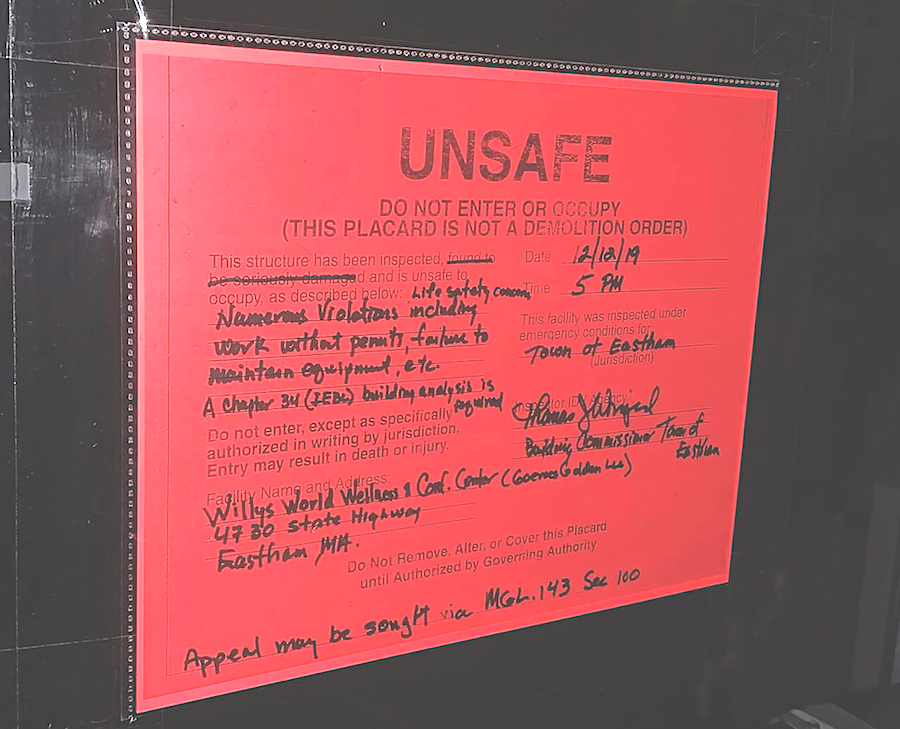

On Dec. 12, the building commissioner found several shortcomings and infractions at the gym during an inspection and closed the gym for violations of fire codes, building codes, and electrical codes.

A review of town records by the Independent in 2020 found health violations and ongoing complaints related to visible mold on the pool room’s walls and ceilings dating back several years. When the ceiling partially collapsed into the pool in 2018, the building commissioner wrote that the cause was extremely high humidity due to lack of proper ventilation.

Niggel has also had a few scrapes with the law. She was indicted by a Boston grand jury in 2014 for failure to make unemployment tax payments and ordered by the attorney general’s office to pay $177,000 in restitution.

In August 2020, Niggel was fined $101,466 by the attorney general’s office for labor law violations. About $20,000 of that amount went to the widow of Joe Abbott, a tennis pro at Willy’s who died in August 2019. Abbott’s wife, Francine, told the Independent at the time that Niggel owed her husband $20,000 for work he had done but was not paid for.