PROVINCETOWN — Unemployment insurance dates back to the New Deal, but it played a starring role in keeping Americans solvent during the Covid-19 pandemic. According to the Century Foundation, more than 1.5 million people in Massachusetts have collected unemployment benefits at some point since the economic shutdown began a year ago. A series of new programs were created by Congress last March to make more Americans eligible for benefits, to keep them eligible longer, and to replace more of their income. Those programs were revised and extended several times in the 12 months since then.

Though the reach of unemployment insurance has expanded, a fiendish maze has arisen for those trying to collect. Benefits can come from different places and expire at different times, and they need to be triggered on and off in a certain sequence. While the people running the system have been buried in legalities, those in need are getting frozen out: payments can be held up for months, key information arrives late or not at all, and I.D. checks can lead to intimidating orders to pay back thousands of dollars.

Because unemployment insurance systems in many states have been targeted by overseas fraudsters, comprehensive identity checks have been implemented.

“It’s the identity checks that are really gumming up the works right now,” said Monica Halas, an unemployment insurance expert at Greater Boston Legal Services. “It sucks the air out of the whole system — there’s not enough people left to deal with anything else.”

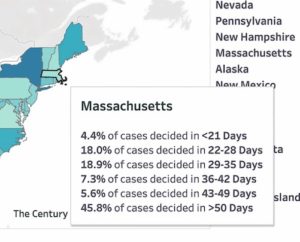

According to data compiled by the Century Foundation, Massachusetts has some of the slowest response times in the country.

In January, only 4 percent of eligibility decisions in Massachusetts were made within the federally recommended 21 days; 46 percent took more than 50 days. And eligibility is actually a separate process from identity verification, which can take even longer.

The state Dept. of Unemployment Assistance “has just started a new method that they’re hoping will speed things up,” said Halas. “This website, called ID.me, has contracts with a bunch of states now. You can go to that website and it should speed up your I.D. verification with DUA.”

A separate problem has to do with transitioning from one new benefits program to another. To the state, it’s hugely significant whether a given week of benefits is paid from the state’s unemployment insurance fund or through the CARES Act or some other federal source. The state will send letters that announce “your benefits are exhausted,” then fail to explain that there’s another program queued up to offer continuing support.

“It’s so confusing — the communication is terrible,” said Halas. “So, first, people should keep on claiming weeks. Do not assume, no matter what notice you are getting, that you are at the end of the line. Second, reach out for help. Call your local legal aid office — for Cape Cod, it’s South Coast Legal Services — or your state representative or state senator’s office.” Given all the programs that have been enacted and expanded, Halas said, nobody who is without a job for a Covid-related reason has actually run out of benefits.

“Honestly, it’s very much like the vaccine website, where you go online and you’re waiting 11 minutes, and then it’s 3 days, and then it’s 2.5 hours. It’s insanity!” said Maggie Flanagan, program director at the Homeless Prevention Council, which helps people access unemployment insurance and a range of other resources.

This is especially relevant because the shutdown order is approaching its one-year anniversary. Because unemployment works on a “benefit year,” people who filed last March will soon be receiving notices that their benefit year has ended. That does not mean there are no more benefits available.

“If your benefit year ends, you need to reapply for regular state unemployment insurance, because they have to test your eligibility for all these programs,” said Halas.

Who’s Covered by What?

The state publishes extremely detailed reports on the “traditional” state unemployment system, but almost nothing at all on the new programs that were devised in 2020. That means there is only a partial snapshot of claimants on the Outer Cape, especially early in the pandemic, when most people were on regular unemployment insurance. As time goes on, and more people move into new programs, it becomes harder to know how many people are benefitting.

Enrollment seems to have peaked in April 2020, when the four Outer Cape towns had about 1,650 people filing for regular unemployment benefits. At that time, those regular benefits plus an augmented $600 per week for all filers meant the program was funneling $1.6 million to the Outer Cape every week.

The Pandemic Unemployment Assistance (PUA) program was created for gig workers, independent contractors, and other people not covered by traditional unemployment insurance. There are no town-by-town data for that program, but the Century Foundation has statewide data for it.

After a bumpy rollout in May, PUA covered almost as many people as regular unemployment insurance did for June and July in Massachusetts. As people left regular unemployment for various other programs, PUA covered more people than regular unemployment in the fall and winter.

As of mid-February, the four outermost towns had 878 people filing for regular unemployment insurance, representing a half million dollars a week in income. If statewide patterns hold here, there could be the same number of people or more on PUA and the other programs.

Neither the state nor the Century Foundation has hard data on how many people are filing and not being paid benefits. It could be a very large number. The Independent has been shown letters from the state saying that an individual’s benefits are exhausted; letters saying identity could not be verified and benefits are canceled; and letters saying that identity could not be verified and all benefits ever paid since 2019 must be paid back — more than $10,000 in some cases.

Those “demands for repayment” can be fully resolved with proof of identity — but finding someone at the state who can process that proof is the problem.

“I get that their system was suddenly overwhelmed,” said Flanagan. “But who are the people being negatively impacted? Once again, it’s the working class and the vulnerable.

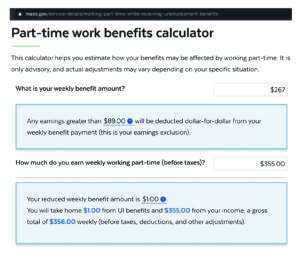

In that situation, the formula for unemployment is based on the average weekly wage in only the higher-earning quarter. The income for the higher quarter is divided by 13 to make the average weekly wage, then divided by two to determine the weekly benefit amount (WBA). Income for the two quarters combined must be at least 30 times the WBA.

In that situation, the formula for unemployment is based on the average weekly wage in only the higher-earning quarter. The income for the higher quarter is divided by 13 to make the average weekly wage, then divided by two to determine the weekly benefit amount (WBA). Income for the two quarters combined must be at least 30 times the WBA. Policymakers will have plenty of options. The PUA program for independent workers ends completely on Dec. 26, said Halas. It was created from scratch in the March 27 CARES Act, and it covered a huge segment of workers who have never had unemployment protections before.

Policymakers will have plenty of options. The PUA program for independent workers ends completely on Dec. 26, said Halas. It was created from scratch in the March 27 CARES Act, and it covered a huge segment of workers who have never had unemployment protections before. Disaster Loans Show Up

Disaster Loans Show Up