PROVINCETOWN — After more than a year of telling town officials that it could not be done, the Mass. Dept. of Revenue has released data on the new tax on short-term rentals. This new tax, which is technically an expansion of the existing “rooms tax” — applying it to short-term vacation rentals, which have dramatically increased due to online services such as Airbnb — has been a long-sought source of revenue for Cape Cod towns.

Provincetown has voted every year since at least 2010 to tax short-term rentals this way. (That year, the vote at town meeting was 236 to 7.) The tax could not be collected, however, until the state passed comprehensive enabling legislation, which finally happened in December 2018.

The tax expansion was put into effect on July 1, 2019 — more than 20 months ago. But as recently as January 2021, the state was telling Provincetown officials that it was not possible to say how much revenue was coming from short-term rental properties as distinct from the “traditional lodgings” covered by the rooms tax, such as hotels, motels, and bed-and-breakfasts.

This breakdown in revenue sources is significant, because many advocates and community leaders have hoped to use the funds gained from the short-term rental tax to support housing, infrastructure, and other specific needs.

The Housing Assistance Corporation and the Cape Cod Chamber of Commerce had advanced town warrant articles in all 15 towns on the Cape to allocate the new money to housing, wastewater solutions, infrastructure, and marketing. (The articles were scheduled for annual town meetings in spring 2020, but they were withdrawn when the pandemic delayed those meetings across the Cape.)

The Homeless Prevention Council of Cape Cod and the Community Development Partnership asked towns to dedicate 50 percent of the new money specifically to housing, in an op-ed essay in the Jan. 27 edition of the Independent.

Meanwhile, the state was refusing to confirm what the new revenue actually amounted to.

It was possible to analyze tax receipts from before July 1, 2019 and compare them to receipts after, in order to see roughly how much the tax expansion was generating. The Independent conducted just such an analysis, and found about $1.7 million in new revenue in Provincetown, $600,000 in Truro, $700,000 in Wellfleet, and $800,000 in Eastham, over a one-year period.

But to actually allocate money requires more than a rough comparison — it requires official data.

“We have been asking for that information since the tax was enacted,” said Tony Fuccillo, Provincetown’s tourism director. “It’s been an ongoing request. At first, they said they were going to do it in a later year. Then they just started saying they don’t have it. I had the impression they couldn’t do it.”

And, in fact, the Dept. of Revenue initially told the Independent that “due to taxpayer confidentiality, DOR cannot offer a breakdown” of the tax receipts.

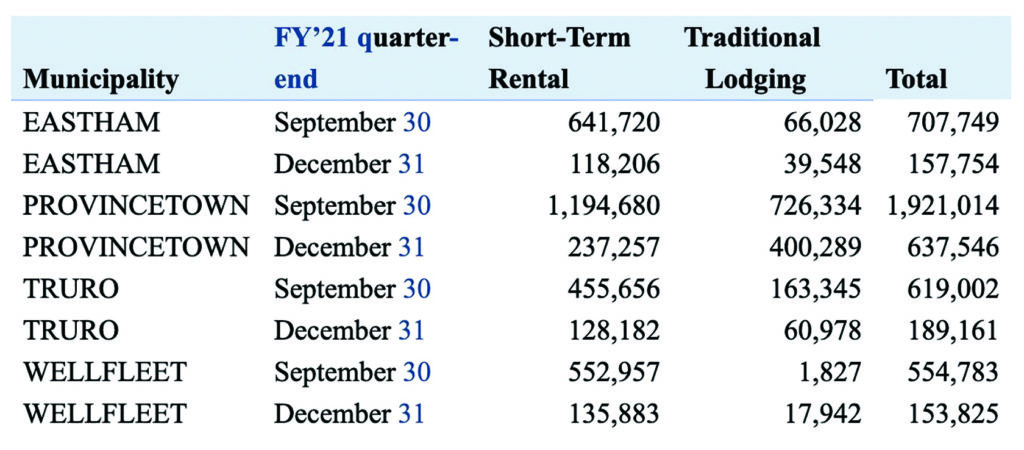

This turned out not to be true. The DOR can indeed offer that breakdown, at least for the two most recent fiscal quarters, which make up the second half of 2020. That breakdown, which the DOR provided to the Independent, is published in the chart on this page.

(The DOR still maintains that it can’t separate the revenue for the first four quarters of the tax’s expansion, from July 2019 through June 2020.)

“This is the first I’ve heard that they’ve broken out those numbers,” said Fuccillo. “It was just back in late January that they told me they couldn’t.”

Provincetown’s tourism budget depends partly on the rooms tax. For 10 years now, Provincetown has split rooms tax revenue four ways: 35 percent to the tourism fund, 13 percent to the wastewater enterprise fund, 27 percent to a capital improvements fund, and 25 percent to the general fund. Truro, Wellfleet, and Eastham all deposit their rooms tax revenue into their general funds.

Assistant Town Manager David Gardner has previously pointed out that Provincetown might want to maintain the existing funding streams into those four funds, while dedicating the new revenue from short-term rentals to other purposes, such as the affordable housing trust fund or the year-round market-rate rental housing trust. The DOR’s insistence that it couldn’t report the numbers that way had prevented the town from dividing old money from new.

A quick look at the new numbers from the DOR shows why advocates are interested in the money.

Provincetown had $1.4 million in tax revenue from short-term rentals in the last two quarters of 2020. Truro had almost $600,000, Wellfleet almost $700,000, and Eastham almost $800,000.

It should be noted that these two quarters correspond to Cape Cod’s high season, and, historically, they account for 90 percent of annual rooms tax revenue. Even so, to paraphrase an old expression: “A million here, a million there, and pretty soon you’re talking about real money.”