PROVINCETOWN — As business owners begin to plan for the season ahead knowing both workers and workforce housing are in extremely short supply, many will try to wrap wages and rent together into as attractive a package as they can.

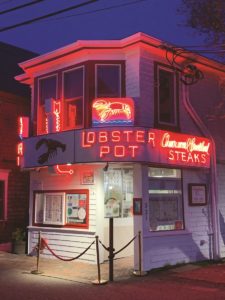

Tim McNulty, co-owner of the Lobster Pot restaurant, has some advice for anyone making those plans: if you’re offering housing and charging your employees rent, do not deduct it from their paychecks. Have them hand over rent checks monthly, as you would have any other tenant do.

It’s advice he learned the hard way, in 2020, when the state attorney general’s office fined his restaurant a total of $156,744.52 (including $132,244.22 in restitution) for “improper deductions for lodging” from 22 employees during the 2016 to 2018 seasons, according to Roxana Martinez-Gracias of Attorney General Maura Healey’s office.

The charges against the Lobster Pot related to housing H-2B visa workers, all from Jamaica, where the Lobster Pot has recruited seasonal staff since the early 1990s. The restaurant provides employee housing to many workers, though McNulty would not say exactly how many.

The restaurateurs deducted rent from employee paychecks for years. McNulty said he charges each employee between $3,000 and $4,000 per season. This includes all utilities, and they can leave their belongings year-round, so the dwellings cannot be rented during the off season, he added.

Of the Lobster Pot’s 110 employees, about 35 are foreign, McNulty said. “We are not trying to be mean to anyone,” he said. “We have people who’ve worked with us for 30 years.”

Until he hired a new attorney to handle the H-2B visas, McNulty said, he did not know it was against state regulations to deduct rent. The state allows employers to take no more than $35 per week from paychecks for housing.

To make matters worse, because the restaurant deducted the rent from paychecks, it reduced workers’ bottom-line salaries, so that it appeared they were paid below minimum wage, McNulty added.

The McNultys made restitution directly to 25 employees, for both minimum wage and rental deduction violations. The largest amount, $6,300, went to three employees; many others received between $2,000 and $6,000. The smallest restitution payment was $750.

Barbara Niggel, owner of Willy’s Gym in Eastham, was also charged with labor and wage violations in August 2020.

Her fines, totaling $101,466.80, were levied for nonpayment of wages to two employees, misclassification involving 21 employees, and two separate charges for violations of earned sick time affecting 22 employees. Martinez-Gracias said she could not comment on Niggel’s charges, however, because the gym owner has appealed and the case remains open.

Niggel has not paid her fines or restitution to the workers, Martinez-Gracias stated by email. Niggel could not be reached for comment.

Four other local business owners were among those cited in the attorney general’s report.

Helen Silva, owner of Pennies Wine & Spirits in Provincetown, had to pay $24,367.74 in January 2019 for untimely payment of wages and for not paying overtime to 16 employees, according to Martinez-Gracias.

Siobhan Carew, owner of Sal’s Place in Provincetown, was fined $10,302.06 in January 2020 for failure to make timely payment of wages to four employees, according to the attorney general’s spokeswoman.

Clifford Hagberg, owner of the Sandcastle Resort and Club in Provincetown, was charged with failing to pay minimum wage to five employees and violating the earned sick time law. He was fined a total of $8,160.75.

Nick Dennis, owner of the cleaning company Spotless New England, was fined $7,255 in January 2018 for nonpayment of wages and failure to furnish records to the attorney general’s office. His fines were for one employee.

Only Niggel and Dennis have not paid the related fines and restitution.