PROVINCETOWN — Bringing a business back from a dead standstill is hard enough. But the problems surrounding that effort during the Covid epidemic are so fiendishly interwoven, they resemble the work of a novelist, not a virus.

Businesses that seek to reopen face entirely new rules of operation, a timeline no one knows yet, and the possibility they might be closed again at a moment’s notice. Their customers may not be free to come here; if they are here, they may have no money; if they have money, they may be too afraid to spend it.

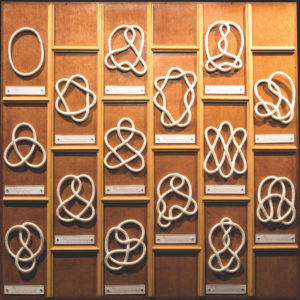

If you got a Paycheck Protection Program (PPP) loan from the Small Business Administration, “forgiveness” is uncertain. The SBA’s disaster loan program seems to have fallen off the Earth. New unemployment benefits could make it harder to hire staff. If employees are coming from overseas, their visas may be canceled. Even with a visa, they may still be unable to fly here. It would make an impressive Gordian knot if so many businesses weren’t trapped inside it.

Missing Disaster Loans

The SBA’s disaster loans were supposed to offer immediate relief, designed to keep cash flowing and accounts current. Instead, the program seems to have collapsed into an administrative black hole from which not even information can escape. The SBA has confirmed almost nothing about the program, and the formula for determining the loan amount is a mystery.

Jeannine Marshall, president of Coastal Community Capital, was on a mid-March webinar with a disaster loan administrator who outlined how the loan amounts were supposed to work. “He described it then as: you take your gross annual revenue and subtract the cost of goods you had to buy,” she said. “Roughly speaking, everything that’s not your cost of goods is your operating expenses. Divide that number by two, and you have six months of operating expenses. That’s the formula for the loan — or at least it was.”

Such loans could actually help keep a business solvent. The disaster loan program has had an additional $50 billion allocated to it — and because that allocation actually pays for the losses on the loans, it should, by Congressional rules, support seven times the amount of actual lending. The SBA is still staggering under the weight of 4 million disaster loan applications, but at some point, that money should start appearing.

Payroll Confusion

The money that has appeared — PPP loans — may present other tangles. These loans are designed to pay for two months’ worth of payroll, at which point they convert into a forgiven loan, never to be repaid. This is a godsend for businesses that never stopped operating (such as this newspaper). For the businesses that have no payroll now because they laid off staff or hadn’t opened yet, it can be a surprise to learn that their payroll must start while they’re closed for the loan to be forgiven.

Just around the corner is another problem: when it’s time to call employees back, many, especially those who rely on tips, will realize that super-enhanced unemployment pays more than working a venue with few customers. A conflict between employers who need loan forgiveness and employees reluctant to return could arise — and the real health risks of reopening complicate matters further.

There are two possible solutions to this logjam.

Employees can work part-time and still receive unemployment benefits. As long as an employee earns up to $1 less than her weekly benefit amount, that employee will still receive the balance of her weekly benefit and the whole extra $600 a week that Congress allocated in the CARES Act, said Monica Halas of Greater Boston Legal Services. The extra $600 a week continues through July 25, and for some businesses, reduced consumer demand and reduced staffing levels might continue as well.

For businesses that can operate closer to full capacity, there is a little-known program called workshare unemployment.

“The business owner has to initiate this plan, which is one reason it’s underutilized,” said Phineas Baxandall, an expert in social insurance at the Mass. Budget and Policy Center. “In workshare, if there are five employees, instead of laying one off, you put all five at 80 percent hours. All five take 20 percent of an unemployment check, which helps make up for the lost wages. For the duration of this year, the federal government is picking up the entire tab for those benefits.”

That means these checks won’t count toward the employer’s next-year contribution to state unemployment insurance (U.I.). The employer is also paying less than full payroll, of course. And the employees each get the extra $600 a week until July 25, courtesy of the federal government. This benefit dwarfs the fractional check that each employee would normally get in workshare.

In normal times, workshare is about saving on payroll while avoiding layoffs. But the feds have issued explicit guidance to employers ramping back up from a pandemic-caused closure: workshare may be used to gradually climb the ladder of increased demand. Employers put their employees into groups, and everyone in the group has to work the same fractional hours, between 40 and 90 percent of full time. The hours worked can increase — up to 90 percent of full-time — and employees will still receive the extra $600 a week, while costing the employer less than state-backed U.I.

What About the Visas?

In mid-March, U.S. embassies around the world suspended visa-related activities. The State Dept.’s website, however, shows that 556 J-1 student exchange visas had already been approved for the four Outer Cape towns before that happened.

Patrick Patrick, owner of the Marine Specialties store in Provincetown, was contacted recently by a J-1 sponsor agency with a long questionnaire, asking about his plans for opening and for maintaining safety. Sponsor agencies have delayed their students’ arrivals in the U.S. — after all, there are no international flights to speak of, and most businesses are closed — but they haven’t canceled them.

The H2-B program, however, is in a tighter spot. For that visa, businesses submit applications for a certain number of employees in difficult-to-fill positions, such as dishwashers and housekeepers. After going through a lottery in late February, applications representing 453 workers were approved in early March. Individual employees still have to be approved at U.S. embassies, however, and that step isn’t possible right now.

If the embassies open in June, H2-Bs and J-1s might all be here by July. Many hotels and restaurants depend on these programs for staff. That means international air travel is just one more obstacle that some business owners have to consider before reopening.