PROVINCETOWN — The rooms occupancy tax and the meals tax draw attention every year for two reasons — they are a reliable indicator of how the tourist industry is doing, and they also are actual tax revenue that support local programs. Normally, what these numbers show about the underlying economy is the more important consideration. If an entire industry is up four percent or down two percent, that’s a big deal; if an annual allocation to a municipal rainy-day fund is up four percent or down two percent, that’s of somewhat less significance.

The tax numbers that town government released last week, however, are important in both respects.

Restaurants had a strong year, up seven percent in the first quarter and five percent in the second quarter compared to 2018. These are some of the best numbers for restaurants in a while, and they probably mean the rest of the tourism sector had a pretty good 2019 as well.

On the other hand, the rooms tax, now that it has been expanded to include short-term rentals on platforms like Airbnb and HomeAway, brought in half a million dollars in new tax revenue in just one quarter. And because the underlying rules have changed, it’s the tax receipts themselves and not the health of the hospitality industry in general that are the story.

The rooms tax was expanded to include short-term rentals effective July 1, 2019. The town of Provincetown had voted for this change at every spring town meeting between 2010 and 2018, but on Dec. 28, 2018, Gov. Charlie Baker finally signed the legislation that turned it into law. Because the tax took effect July 1, the May-June-July quarter of 2019 included only one month with the expanded tax. That quarter saw tax receipts go up by $160,000.

The next quarter, the August-September-October quarter, was the first with the tax fully in place, and tax receipts went up by $512,000, or 49.6 percent.

The next two quarters of the fiscal year correspond to November-December-January, and February-March-April, and historically see very little income from rooms tax. However, the two quarters that have already passed have produced $672,000 of extra tax revenue between them, and the expanded tax was in effect for only four out of those six months. For the coming year in which all 12 months have the expanded tax, $672,000 in extra revenue would probably be on the low end.

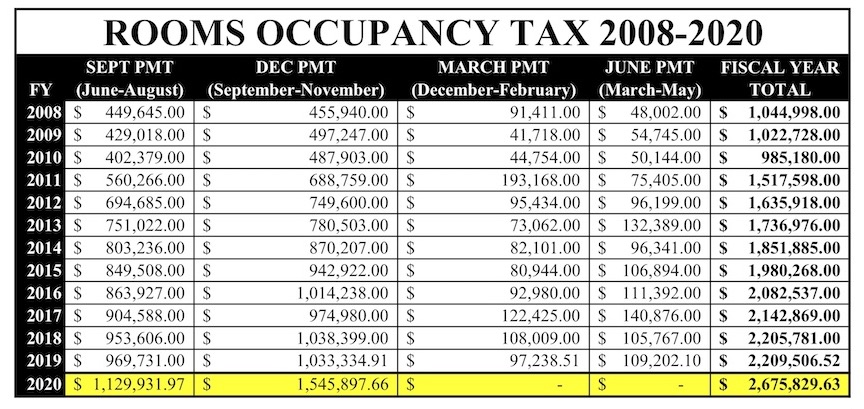

The rooms tax revenue is used four different ways in Provincetown: 35 percent is earmarked for the tourism fund and used to support a range of direct marketing for the town; 27 percent goes into the general fund; 25 percent goes into the rainy-day fund; and 13 percent goes into the wastewater enterprise, or sewer, fund. For the last five years, total room tax receipts for the year have averaged about $2.1 million, and that money has been split according to those percentages. If an expanded rooms tax were to generate consistently greater revenue, that would mean more money moving into these four funds.

“We have asked the state dept. of revenue to break out the rooms tax for us and separate the income from licensed lodgings that have historically paid this tax from the newer income that’s coming from short-term rentals,” said Provincetown Director of Tourism Tony Fuccillo. “They don’t have that breakout available yet, but they’re supposed to be working on it.”

In the meantime, the new money from short-term rental taxes will continue to be allocated according to these formulas — which means the rainy-day fund is having a pretty sunny day.