PROVINCETOWN — The $2 trillion CARES Act turns three months old this week, and the relief programs it created have all had rough rollouts. The payroll loans, disaster loans, and unemployment insurance expansion were each a perfect storm of panic, confusion, and delay. Together, they were a sort of Bermuda Triangle of financial relief — disorienting and daunting, even to the most prepared.

For the first time since the law was passed, however, all three programs seem to be on course. The disaster loans are finally being released, which is very big news for the small businesses that applied for them back in late March. The payroll loan terms were revised several times; they can now be used over the course of six months rather than two and still be forgiven. And the expanded unemployment system, which was rushed into place, is now circling back, documenting people’s prior income, and in many cases revising their weekly benefit upwards.

Disaster Loans Show Up

Disaster Loans Show Up

Even before the CARES Act was passed on March 27, the Small Business Administration (SBA) set up the Economic Injury Disaster Loan, or EIDL, building it out of a pre-existing disaster loan program that normally kicks in after hurricanes or wildfires. The CARES Act put $10 billion into the program, but by that time nearly four million businesses had already applied.

Each EIDL loan was originally supposed to equal six months of a business’s operating expenses, according to Jeannine Marshall, president of Coastal Community Capital. That’s a big loan, relative to a year’s budget, meant to give businesses real flexibility in an emergency. Four million loans averaging $100,000 each, however, would be $400 billion of loans. The $10 billion in the CARES Act was nowhere close to covering the demand, and throughout April and May, only a tiny number of EIDL loans trickled out of the SBA.

Congress put more money into the program in late April, yet for weeks the disaster loans were nowhere to be found. Finally, around the beginning of June, the money started to flow.

“The Massachusetts office of SBA has been approving 800 to 1,000 loans a week for the last three weeks,” said Pam Andersen, director of business and credit programs at the Community Development Partnership in Eastham. “I’ve heard from a lot of businesses that they’re finally getting something. I’ve also heard to check your spam filter, because some key messages from SBA could have gone there.”

Andersen also noted that the portal to apply for a disaster loan, which has been closed since April 15, was reopened on June 15. If your business isn’t one of the four million that applied in March, there might be a second chance if you apply now.

New PPP Loan Terms

The Payroll Protection Program was always better funded than EIDL, but it was a confusing mess all the same. When Congress invented it in late March, it imagined a short disruption to the economy from the coronavirus — maybe a two- or four-week shutdown that would be all over by summertime. The loans were written to cover eight weeks of payroll, on the theory that the fully forgivable money would persuade employers to forego layoffs.

The program was rushed, however, the rules were constantly changing, lots of layoffs happened anyway, the shutdowns dragged on through May, and many employees chose the generous unemployment benefits that were also provided in the CARES Act. Employers lobbied to be allowed to use the payroll loans after they reopen, instead of being required to maintain a full payroll while they were closed.

In early June, Congress authorized those changes. Payroll loan money can now be used over the course of six months, and 40 percent of the total can be used on rent, utilities, and mortgage interest. That longer time horizon means when and how to use the money is no longer an immediate crisis. Under the old rules, this week would have been the last week to use all of it, and businesses would have been scrambling to build up their total payroll to 2019 levels to secure full loan forgiveness. That messy scene has been avoided, and businesses can now use the money gradually as they open back up to normal levels.

UI: Read the Fine Print

Many states are still struggling to get unemployment benefits to people who have been laid off in the pandemic. Massachusetts had one of the most generous unemployment systems prior to this crisis, and it was able to start getting money out to newly eligible people faster than most other states.

Many of those newly eligible people filed under a temporary program called Pandemic Unemployment Assistance (PUA). This CARES Act program includes a minimum benefit amount — in Massachusetts, it’s $267 a week, with an extra $600 for every week between April 4 and July 25.

When PUA first went live on April 20, it didn’t ask for income documentation, explained Monica Halas, an unemployment insurance expert at Greater Boston Legal Services. In order to speed the process, PUA just assigned the $267 number to nearly everyone. Now, the system is sending out emails, asking people to verify their 2019 income. It’s important to look for those messages and answer them, said Halas, because people who are currently getting the $267 could be getting more.

“The state says the response is due Dec. 30, but people should respond as quickly as possible to get the higher rate,” Halas said. The extra money would be retroactive to the first week of the PUA claim. “A higher weekly benefit also means the person could have more part-time earnings before being bumped out of the program,” Halas added.

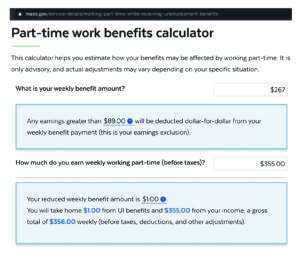

The part-time earning rules are not stated consistently on the state’s website, Halas noted. “The Dept. of Unemployment Assistance is calculating it correctly, but they’re describing it incorrectly,” she said. “When it comes to part-time work, a person can earn 133 percent of their weekly benefit amount, minus one dollar, and still qualify for the extra $600 a week. I’m rock solid on that — you can print it. That’s for PUA and for the regular state unemployment program.”

There is a “Part-time work benefits calculator” on DUA’s website, and it confirms Halas’s account. These rules on part-time work are especially relevant now, as businesses are reopening gradually with various restrictions on capacity.