PROVINCETOWN — When much of the American economy was forced to shut down last March due to Covid, Congress passed trillions of dollars of relief spending in just weeks. There was a scramble to access emergency funding such as the Paycheck Protection Program (PPP), which offered forgivable loans equal to 2.5 months payroll for businesses with 500 or fewer employees.

The situation now is more orderly, and significant sums are flowing again. In addition to a new round of payroll loans, there are several other programs, many of them targeting the smallest of businesses. But those businesses may not be aware of them.

The Targeted EIDL Advance is a $20-billion program (based on the Emergency Impact Disaster Loan program in the CARES Act) that was included in the near-trillion-dollar stimulus bill that Congress passed in December.

The original EIDL program wrote large loans that are repayable over 30 years to the Small Business Administration (SBA), as well as $10,000 “advances,” which were essentially grants.

But not every applicant got a $10,000 advance. After a crush of nearly four million applications, the SBA changed the terms to $1,000 per employee, up to a total of $10,000. Data released by the agency in December show that 615 businesses in the four Outer Cape towns received EIDL grants — but only 71 received the full $10,000, and 336 received only $1,000.

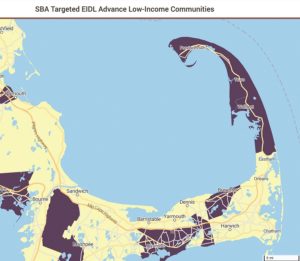

The Targeted EIDL Advance program aims to circle back to these businesses and top up their grants to $10,000. Only businesses that can show a loss of 30 percent over any eight-week period in 2020 are eligible — but given the two-month lockdown, that’s a threshold many can meet. And only businesses located in a “low-income community” are eligible — meaning census tracts with a median family income that is less than 80 percent of the state’s median.

By this standard, Provincetown, Truro, Wellfleet, and the northern half of Eastham are low-income communities. The southern half of Eastham — south of Doane Road from Route 6 to the ocean, and south of McKoy Road on the bay side — is not. That means between 400 and 500 of the smallest local businesses, most with five or fewer employees, can apply for these expanded grants.

“There hasn’t been much publicity for the Targeted EIDL loans,” said Marc Goldberg, a director at the Service Corps of Retired Executives Cape Cod, which provides mentoring and other assistance to local small businesses.

One reason for limited visibility may be that the SBA sent emails to business owners inviting them to apply, and they’re easy to miss. They were sent starting Feb. 1; in the subject line was the application number of the original disaster loan.

More Grants

Another program focused directly on the smallest businesses is managed by the Community Development Partnership (CDP) in Eastham and is still taking applications from residents of the eight Lower and Outer Cape towns. The CDP’s microenterprise program includes $10,000 forgivable loans that can be used for a range of business expenses. Only businesses with five or fewer employees can apply, and only if the owner is personally earning less than 80 percent of “area median income.”

One reason the targeting is narrow is that this program only has about $400,000 to give out. Only 28 grants have been awarded so far. CDP staff are available to help people who haven’t applied yet, said CEO Jay Coburn. (Details are at capecdp.org.)

Another 86 businesses on the Outer Cape have received larger grants from the state via the nonprofit Mass. Growth Capital Corporation (MGCC). Like the CDP grants, this money originated with the CARES Act, was delivered to the state in the summer, and was allocated to a nonprofit to administer it in the fall. Unlike the CDP grants, the MGCC program covered the whole state, and ultimately had more than $650 million to give away.

Applications for the MGCC grants are closed now, but the program has delivered almost $4.4 million to the four outermost towns, and grants are still being paid. They range from $5,000 to $75,000 and are fully forgiven after proper documentation.

PPP Redux

Finally, the Biden administration has just announced new rules to help sole proprietors and independent contractors access the second round of PPP loans.

Previously, people who are in business alone had to use their net income (after deductible expenses) to calculate the size of their payroll loan. As a result, some people’s April 2020 PPP loans were only a few hundred bucks.

For the ongoing second round of PPP loans, independent contractors and other self-employed people can use gross revenue to calculate the size of their forgivable loans, making them significantly larger.

The first round of PPP loans generated $37 million for 571 local businesses on the Outer Cape. Of those, at least 130 were one-person enterprises that might do better in this second round.

Businesses in food services and accommodations can also look forward to the second round of PPP loans. The December stimulus bill authorized PPP loans equaling 3.5 months of average payroll for those businesses, instead of 2.5 months.

The hospitality industry is the largest employer in each of the Outer Cape’s four towns, according to the Cape Cod Commission, and the next round of payroll loans has the potential to bring well over $40 million into the local economy.

Meanwhile, there’s another bill nearly the size of the CARES Act working its way through Congress.