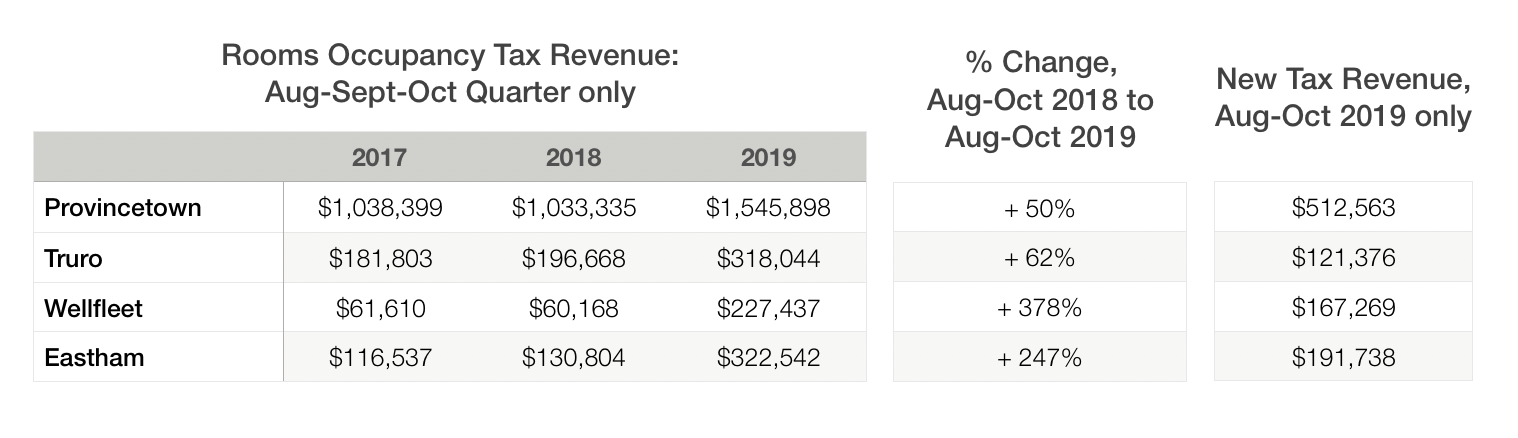

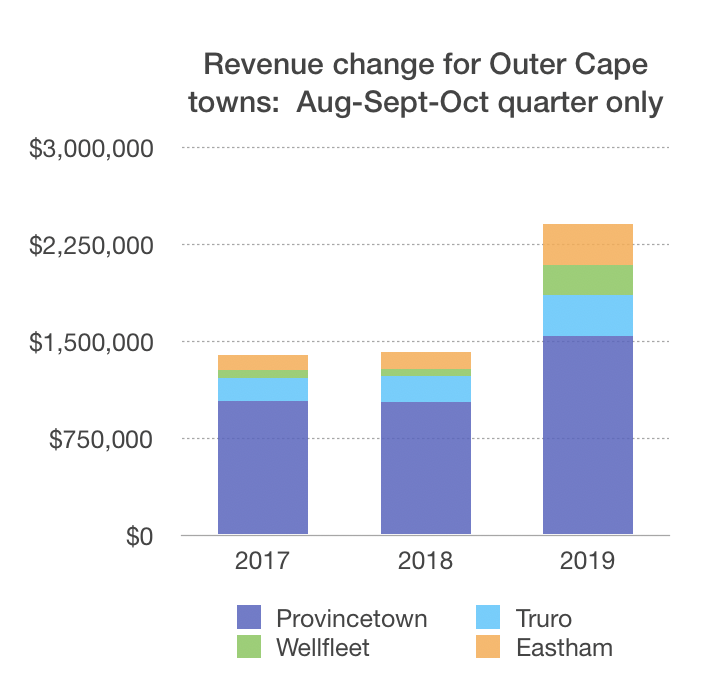

PROVINCETOWN — After a year of commotion and confusion, the expansion of the rooms occupancy tax to cover short-term rentals is beginning to produce its intended dividends. In the first full quarter for which the tax was in effect, that is, August, September, and October 2019, the tax added just under $1 million in revenue for the four Outer Cape towns.

Years of debate in town meetings and the state legislature preceded the change; the final version was signed by Gov. Charlie Baker on Dec. 31, 2018, and the bill took effect the next day: all rentals beginning after July 1, 2019 had to pay the state’s 5.7-percent rooms tax, as well as any local-option taxes that municipalities levied.

Years of debate in town meetings and the state legislature preceded the change; the final version was signed by Gov. Charlie Baker on Dec. 31, 2018, and the bill took effect the next day: all rentals beginning after July 1, 2019 had to pay the state’s 5.7-percent rooms tax, as well as any local-option taxes that municipalities levied.

Provincetown had long ago established a 6-percent local-option rooms tax, while Truro, Wellfleet, and Eastham all set the rate at 4 percent. In addition, Cape and Islands towns had a mandatory add-on of 2.75 percent for water pollution abatement.

In addition to concerns about the effect of the hefty tax increase on visitors, there were logistical challenges: who would collect the tax, and on what schedule would it be paid to the state. Airbnb’s host forums show nearly an entire year of confusion for hosts in Massachusetts.

Wellfleet, Truro, and Eastham all direct rooms tax revenue into their general funds, according to officials in the three towns. Eastham’s select board and administration have already decided to direct the new revenue into town reserves and future capital projects, according to Michael Lorenco, finance director and assistant town manager.

Wellfleet, Truro, and Eastham all direct rooms tax revenue into their general funds, according to officials in the three towns. Eastham’s select board and administration have already decided to direct the new revenue into town reserves and future capital projects, according to Michael Lorenco, finance director and assistant town manager.

Provincetown splits the revenue from the rooms tax four ways: 35 percent to the tourism fund, 27 percent to the general fund, 25 percent to the fund that supports long-term capital projects, and 13 percent to the sewer fund. The town manager’s budget proposal for the next fiscal year mentions options for the new revenue from weekly taxes. It’s possible to preserve the existing formula untouched, explained Assistant Town Manager David Gardner in an interview; it’s possible to adjust the formula so that each of the four funds gets some of the new money and some goes to a fifth or sixth priority, such as the Affordable Housing Trust or the Market-Rate Rental Trust. It’s also possible to adjust the formula so that all the new money goes to new priorities.

“There is a general principle in town finance to try to have some kind of logical nexus between a given tax and the way that money is spent,” said Gardner. “Since weekly rentals do remove housing from the market, there is a certain logic to using weekly rental tax money to help address the housing situation.”

Ultimately, the decision will go to the select board and to voters who instituted these taxes in the first place, Gardner said. “This is a discussion that everyone in town, including the select board and town meeting, is going to have to have,” he said.